With the end of the fiscal year fast approaching, it’s time to talk about everyone’s favorite topic: tax time! And, if you’ve been wondering where your outdoor shed comes into play, we’re here to help you out.

Here are some of the questions we’re going to tackle, here:

- Can you class your shed as a business expense?

- What is the depreciating value of a shed?

- What other expenses can you claim when you work in your shed?

- When is the best time to buy a shed?

- Where can you get more information on your unique situation?

Let’s get started!

Can you class your shed as a business expense?

First, let’s talk about the differences between a shed on your personal property that you may use for business and a shed that is located on your business property.

If the first is true, the ATO states that you must calculate what’s called your taxable purpose proportion. This is a percentage that reflects the amount of time you use the shed as your workplace. For instance, if you spend half of your time in the shed enjoying your own meditation practice, and the other half of your time teaching meditation, then the taxable purpose proportion would be 50%. The idea is simple, but it’s important to be able to prove this number to the ATO through receipts or other relevant paperwork.

Once you have the taxable purpose proportion, you multiply it by the cost of the asset (and in the next section, we’ll talk about depreciating value) to get the number you can use for your deduction.

Now, let’s say that you have a shed that is on your business property and therefore is used for business 100% of the time. As long as the shed and all of the tools and equipment inside are worth less than $30,000, it can be written off as a business expense.

What is the depreciating value of a shed?

Outdoor sheds are considered depreciating assets, which means that unlike a home, their value decreases over time. According to BTM Quantity Surveyors and depreciationrates.net.au, free-standing sheds, like the one the you would have in your backyard, have an effective life of 15 years, with a diminishing value rate of 13.33%.

This is helpful information for you to know when you’re trying to figure out how much your shed is worth after you’ve had it for a number of years.

What other expenses can you claim when you work in your shed?

Of course, if you’re using your shed for your business, it’s not just the initial cost of your shed that you can include in your taxes. Here are the other business expenses that you can include, according to the ATO information about running your business at home:

- Utilities hooked up to your shed: gas, electricity, etc.

- Phone costs associated with your business. The tricky part is that even if your phone is used only for business, you can only claim the cost of rental and calls, not the cost for installation. And, if you’re using the phone for your personal use as well, you can only claim the business calls.

- Decline in value of the equipment in your office. Things like computers, office furniture, and even light fixtures and window coverings are counted as depreciation claims

- The cost of occupying the space where your shed is located. If you are renting the property or paying a mortgage, and if you’ve taken out insurance for the property, the part that goes towards you business can be deducted.

Clearly, there are many expenses that can go towards a deduction. However, what you probably noticed is that the laws are very strict about separating your business from your private life. Make sure that you keep clear records to avoid any confusion in the future.

What is the best time to buy a shed?

Obviously, you can buy a shed whenever the time is right for you. In fact, many people wait until they’ve received their tax refund to purchase a shed.

But, you’ll be eligible for the deduction the year that your shed has been set up for your business use. For example, if you buy your shed today and use it for storage for a few years before converting it into your home office, you can list it as a business expense only during that year that you start generating income out of that space.

What if I have more questions?

Taxes are complicated and can be different for everyone. Especially if you’re going to be using your backyard shed for business purposes, it’s a good idea to talk to a tax professional to get a sense of what you’ll be able to including in your taxes and what documentation you might need to prepare.

Here are a few resources that may be able to answer more of your questions in the meantime:

- The ATO Website. They have a ton of useful information about every element of tax deduction. Some of the more helpful pages for shed owners include: running a business from home, depreciation and capital expenses and allowances, and buying and using assets

- Money Magazine is usually pretty good about publishing up-to-date articles that simplify the tax process. Check out their articles: The ATO’s Hit List and How to Take Control of Your 2019 Taxes

- If you’re a farmer and are using your shed for agriculture, here are a few key resources: ATO Fencing and Fodder Storage, Department of Agriculture and Water Resources information on taxation measures, and this article on Tax Deductibility of Farm Sheds by Flor-Hanly commercial and agribusiness accountants.

More Questions? Let us know!

If you have tax questions, we’ll try our best to help you get to the answers. Although we’re not tax experts, we do have quite a bit of experience with sheds and shed owners.

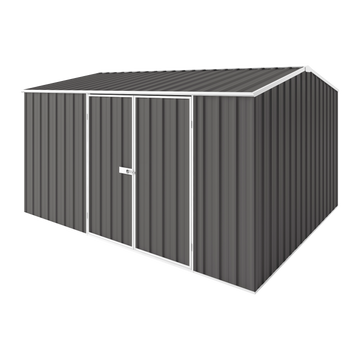

And, if you’re looking for the perfect way to spend your tax return, well, look no further! Our garden sheds are just waiting for you to browse on our website. It’s always a great time to purchase the garden shed of your dreams.